ESTIMATION OF THE OWNING & OPERATING COSTS.

Along with the trend for mechanization adopted for economical and satisfactory job accomplishment, equipment costs now occupy a large proportion of the overall construction cost. Therefore, the estimation of the equipment costs has become more important. Success or failure in a contract for a construction job is virtually dependent on the estimates of the equipment costs. In other words, careful consideration of the equipment costs is of prime importance, if a contractor is to fulfill the contract at a profit. Unless estimates are made properly, there will occur cases where a construction job cannot be accomplished at a profit.

There are two types of equipment costs: owning costs and operating costs. Owning costs refer to the costs incurred even if the machine is not working. They include depreciation, interest, taxes and insurance. Operating costs are the costs incurred in actually operating the machine. They include costs for repair, fuel, lubricants, tires, special items (consumable parts such as ground engaging tool) and operator's wages.

We would like to explain one method of estimating the owning and operating costs of construction equipment in this handbook. The owning and operating costs of construction equipment can vary widely because they are influenced by many factors: the type of work the machine does, local prices of material, labor, fuel and lubricants, interest rates, etc. Accordingly it is very dangerous to estimate the costs relying entirely on an established form of calculation method.

In this Manual, however, we will make approximate estimates of general application of the equipment costs. Accordingly, if users want more accurate values of the costs, we hope that they will make estimates by taking into account their own reference data and territorial or environmental conditions. Depreciation period, and repair and periodic maintenance cost are especially affected by specific application and type of work. Therefore, if you need those data, we suggest that you contact the local Komatsu distributor with necessary information.

The equipment owning and operating costs are calculated in units of $/m3, $/m2 or $/h, etc., depending on the type of construction work. The costs in $/m3 or $/m2 are obtained by dividing the cost in $/h by production (m3/h) and thus, it is recommended that the owning and operating costs be calculated in the unit of $/h as generally accepted.

1. OWNING COST

The equipment owning cost is the expense required, as a matter of course, for the purchase and possession of the equipment as a property of its owner and consists of the following two items.

(1) Depreciation

(2) Interest, insurance and taxes

1-1.DEPRECIATION

In general, depreciation is a tax term referring to the legally permitted decline in value from the original purchase price of equipment, and is an assessable property (expressed in units of years). Depreciation referred to herein is a business practice for conserving the investment in the form of purchased equipment, in other words, for making preparations in a systematic manner for the fund necessary for replacing the existing equipment with new or any other equipment.

Net depreciation value means Original purchase price minus Resale or Trade-in price.

The depreciation period varies considerably according to the equipment operating conditions. It is also affected by the speed of fund collection desired by the user, environmental and economic conditions in its applied territory. Furthermore, it goes without saying that maintenance of equipment is a significant

where n: Depreciation period

(Example)

Delivered price: $100,000

Annual rates: 15%

Annual use in hours: 2,000 hrs

Trade in value: $25,000

Depreciation period (n) : 4 years

Solution

When obtaining the factor by using Table 1.

Enter r = 0.25 in Table 1

Move vertically to n = 4 line and horizontally to left axis.

Applicable factor is 0.72

Table 1 Factor of Interest, Insurance, Taxes

2. OPERATING COST

The equipment operating costs are proportional to the time that the equipment works. Items considered in this category are as follows:

(1) Fuel

(2) Lubricants (oil and grease), Filters and Periodic Maintenance

Labor

(3) Tires

(4) Repair Cost

(5) Special items (Ground engaging tools)

(6) Operator's wage

2-1. FUEL

More definite fuel consumption data should be measured in the field. It is possible, however, to anticipate the actual or approximate consumption values according to the actual operating conditions without measuring the consumption. Table 3 gives the hourly fuel consumption values for KOMATSU construction machines. In this table, the average values are given, provided that the job conditions are classified into three different ranges of application. If a user has data on certain operating conditions, more correct or realistic values will be obtained by applying these data in similar operating conditions, provided that the equipment is limited to the same type as that used in the user's data.

To estimate hourly fuel cost, select the job condition based on application and find hourly fuel consumption.

Hourly fuel cost = Hourly fuel consumption × Local unit price of fuel

2-2. LUBRICANTS (OIL AND GREASE), FILTERS AND PERIODIC MAINTENANCE LABOR

The consumption values of lubricants can be calculated on the basis of lubrication intervals which are described in the Operation & Maintenance Manual of each model, but they are affected by their operating conditions and sulpher contents in the fuel.

Prices of lubricants vary in countries or areas and, therefore, the local price (price in that country or area) should be used. In KOMATSU construction machines, filter replacement intervals are standardized for each machine model. Thus, the cost of filter can be calculated from the local price of filter and the replacement interval. The hourly filter cost is the total of the hourly costs for each type of filter.

3. EXAMPLE OF CALCULATION

PC200 is delivered for $92,811 at a job site.

Applications:

Mass excavation or trenching where machine digs all the time in natural bed clay soils. Some traveling and steady, full throttle operation.

Net Depreciation Value

Since the machine is a crawler-type, tires are not involved. This owner knows from experience that at trade-in

time, the machine will be worth approximately 10% of its delivered price 4 years from now.

Trade-in value is $9,281

Net depreciation value = $92,811 – $9,281 =$83,530

OWNING COST

Depreciation:

Putting 10,000 hours as the example depreciation period.

Interest, Insurance, Taxes

Owner plans to use machine during 4 years and about 2,500 hours per year.

Calculate the Factor according to depreciation period and trade-in value rate, which is 0.66.

Enter the annual rates of interest, insurance and taxes and total them, which is 0.14 as an example.

Add up the depreciation cost and annual interest, insurance, taxes cost for total owning.

OPERATING COST

Fuel: See Table 3.

The intended application is in medium range. The estimated fuel consumption from table is 12.5 liter/hour.

Cost of fuel in this area is $0.2/liter.

Consumption × Unit cost = 12.5 liter/hr × $0.2/litre = $2.5

Lubricants, Filters and Periodic Maintenance labor:

Use local Komatsu distributor’s estimation. (For calculation example: use $0.39)

Tires are not involved, since the machine is crawler type.

Repair Cost

Use local Komatsu distributor’s estimation. (For calulation example: use $3.30)

Repairs = $3.30

Since the machine does not have fast wear parts like ripper points of bulldozer or cutting edge of motor

grader, special item can be disregarded.

Operator hourly wage in this area is $16.00.

Add up the fuel cost, lubricant grease filter costs, repair cost and operator's hourly wage for operating cost.

TOTAL HOURLY OWNING AND OPERATING COSTS

Add up the total owning cost and total operating cost.

The following tables show application and operating conditions in three categories.

Condition 1 is the light duty for machine, conditions 2 is the average and Condition 3 is the severe duty. It is the guide line and can be used with fuel and tire life tables to assist to select fuel and tire costs.

Table 2-1 Application and Operating Conditions

Table 2-2 Depreciation Period Based on Application and Operating Conditions

Table 3 Hourly Fuel Consumption

(1) Bulldozers

Low: Machine movement is mainly consisting of idle running or traveling unloaded.

Medium: Average earth moving, scraper hauling or easy pushing operation.

High: Ripping, heavy pushing, and operation continued without rest at full horsepower.

(2) Dozer shovels

Low: Operation mainly without full load on engine.

Medium: Average loading on ground or hill without full load on engine.

Loading operation accompanied by traveling from stockpile.

High: Continued digging (excavating) and loading operation with engine at full throttle.

(3) Pipelayers

Tire Life

Table 4 Approximate Tire Life

The life varies with brand and material. Tires may be used above or below the tire life expectancy given in this

table.

Table 5 Approximate Usable Hours of Special Items

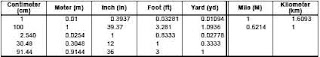

Unit Conversion Tables

a. Length

b. Space

c. Volume

d. Weight

e. Pressure

f. Velocity